AADR: 4th Quarter 2025 Portfolio Review

Strategy

The AdvisorShares Dorsey Wright ADR ETF’s (AADR) strategy uses relative strength to allocate towards the strongest performing ADR’s in Developed and Emerging Markets. The strategy starts with a top down approach, first ranking each sector based on its relative strength scores and then setting the weighting of each sector. Holdings are scored daily based on an in-house momentum score which compares each security to the peers in the universe. If a securities rank falls below our sell threshold, it is removed. The strategy is not constrained to holding a set allocation to Emerging or Developed Markets, rather the process identifies areas of strength across the globe regardless of geographical location. This allows the portfolio to over or underweight regions and markets to concentrate on areas of strength, often pushing the portfolio to vary dramatically from international benchmarks.

Performance

AADR underperformed the MSCI All Country World ex-US Index by -5.56% in Q4—(0.67%) (NAV) | (0.46%) (market) vs. 4.89% (MSCI ACWI ex-US). This widened the gap on 2025 performance between the two to (5.68%) where AADR is up +25.54% (NAV) | 24.77% (market) vs. 31.22% for the benchmark. Most of the quarterly divergence came from investments in China that turned south over the course of the quarter. In fact, 8 of the 10 worst performers came from China (specifically in the Technology and Consumer Discretionary sectors). This, combined with our unwind from the Argentina trade that helped so much in 2024 caused the underperformance for 2025. The US dollar also provided a tailwind to all international stocks last year making it harder for relative strength to delineate winners from losers. We feel it’s unlikely for the US dollar to fall as much again this year which should help the strategy in 2026 with relative performance.

Holdings

The portfolio continues to be allocated to securities we believe display favorable relative strength characteristics. At any given time, the portfolio will be comprised of 30-40 US traded ADR’s from our universe of 300-450 ADR’s. Currently, the portfolio consists of 36 securities with weights ranging from ~1.78% to ~5.31% with the top 10 holdings comprising roughly 37% of the portfolio. The portfolio had a few trades this quarter where we increased exposure to Japan, France, Belgium, Denmark, Israel, and Taiwan and reduced exposure to China, Argentina, Germany, Spain, South Korea and Mexico.

Top 10 Holdings

| Ticker | Security Description | Portfolio Weight % |

| ERJ | EMBRAER SA-SPON ADR | 5.51% |

| BBVA | BANCO BILBAO VIZCAYA-SP ADR | 4.66% |

| HMY | HARMONY GOLD MNG-SPON ADR | 3.99% |

| GFI | GOLD FIELDS LTD-SPONS ADR | 3.98% |

| BCS | BARCLAYS PLC-SPONS ADR | 3.90% |

| MUFG | MITSUBISHI UFJ FINL-SPON ADR | 3.58% |

| SBSW | SIBANYE-STILLWATER LTD-ADR | 3.41% |

| CYD | CHINA YUCHAI INTL LTD | 3.33% |

| BVN | CIA DE MINAS BUENAVENTUR-ADR | 3.24% |

| ABVX | ABIVAX SA-ADR | 3.23% |

As of 12.31.2025. Holdings are subject to change.

Geography

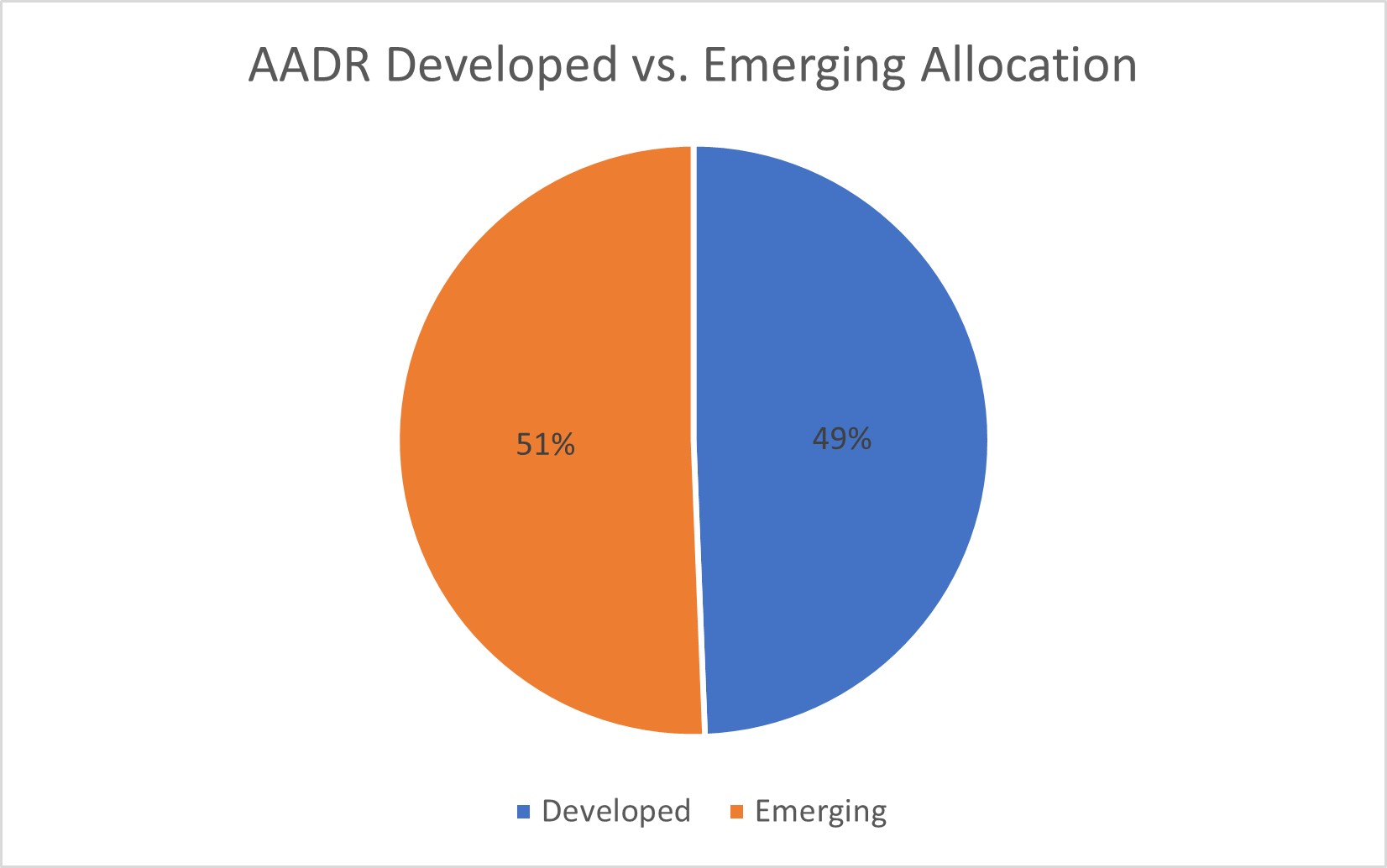

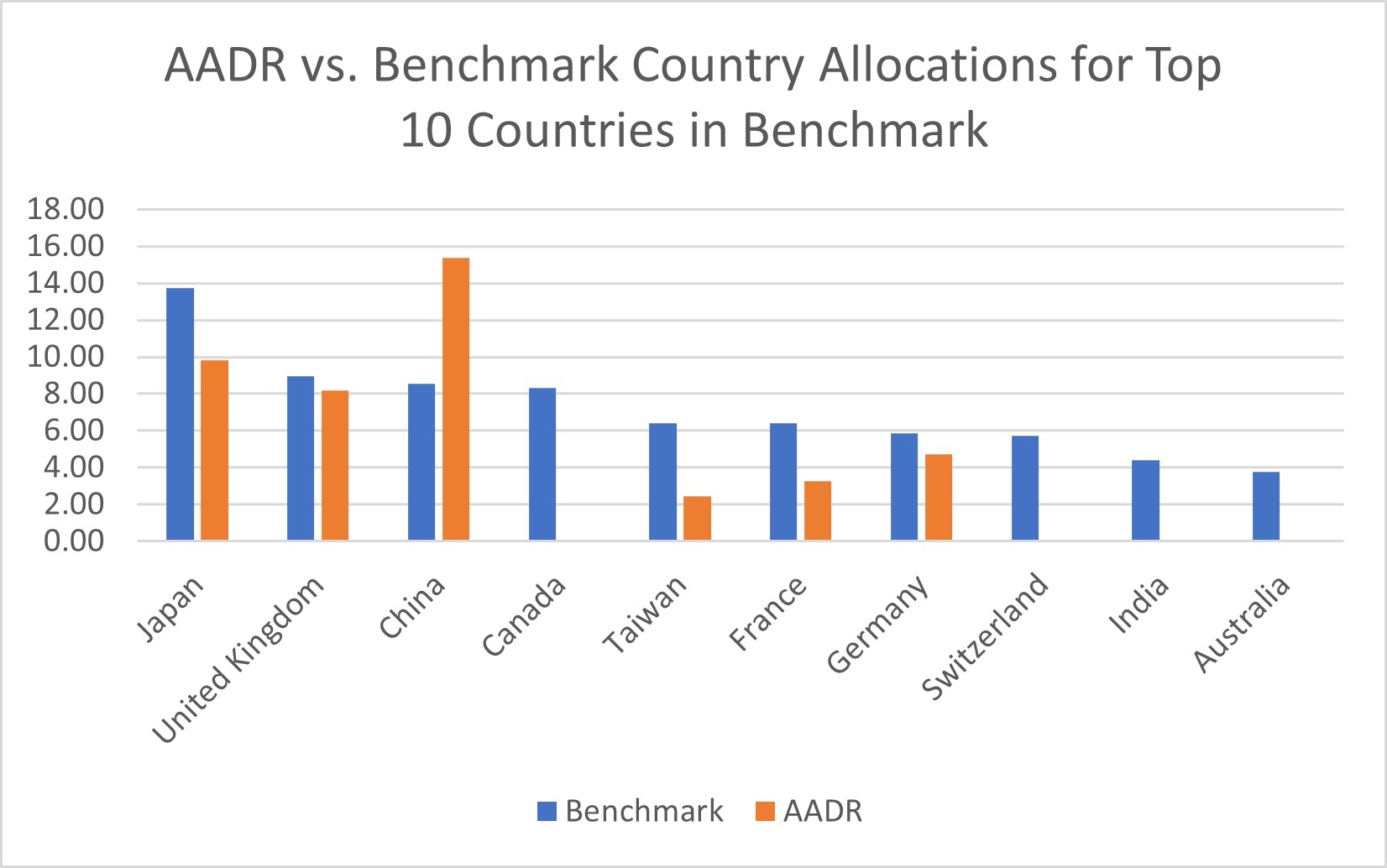

The portfolio’s process of focusing on sectors and the strength of holdings allows the portfolio to look much different than the broad market benchmark. The current allocation also looks different when comparing Developed Market vs. Emerging Market exposure. The portfolio currently holds more Emerging vs. Developed (50.58% vs. 49.36%). The country allocations are also substantially different. As can be seen below, AADR holds no exposure to Canada, Switzerland, India, and Australia and reduced exposure to Japan and the UK which are both large weights in the benchmark. Instead, we have excess allocations to countries like China where we’ve still seen areas of relative strength in despite recent pullbacks. At times we’ll own many countries which would never have large allocations in a passive benchmark.

As of 12.31.2025. Source: Nasdaq Dorsey Wright.

Sector

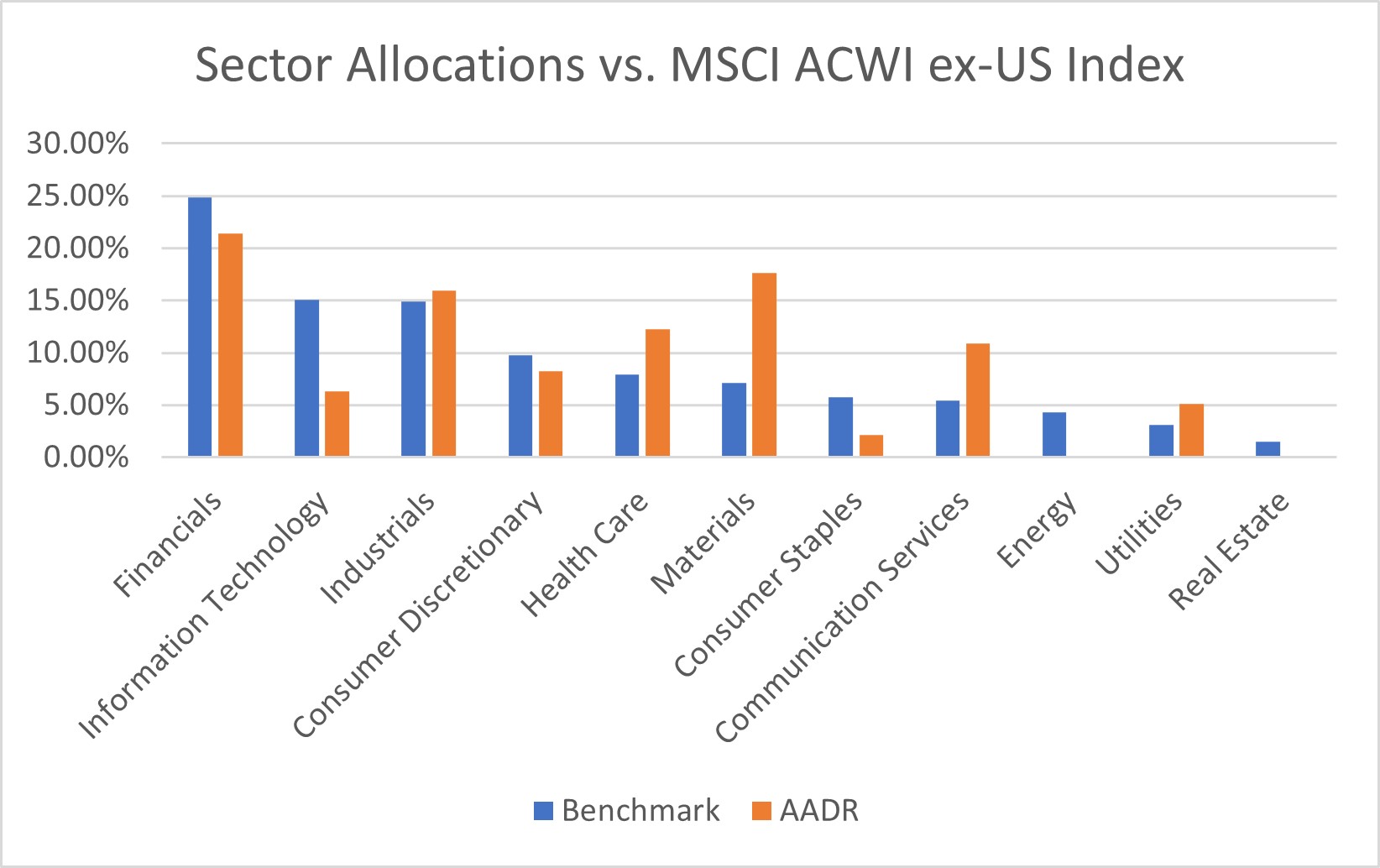

The buy/sell process of the strategy starts with a look at the strongest sectors within the universe, overweighting strength and underweighting or eliminating relative weakness. The portfolio continues to be actively allocated to sectors in a materially different way than the benchmark. Notably, the portfolio is most overweight in Materials, Communication Services, and Health Care while most underweight in Financials, Information Technology, and Energy.

As of 12.31.2025. Source: Nasdaq Dorsey Wright.

John G. Lewis

Nasdaq Dorsey Wright

AdvisorShares Dorsey Wright ADR ETF (AADR) Portfolio Strategist

Past Commentary

Definitions:

An American Depositary Receipt (ADR) is a negotiable U.S. Security that generally represents a company’s publicly traded equity or debt. Depositary Receipts are created when a broker purchases a non-U.S. company’s shares on its home stock market and delivers the shares to the depositary’s local custodian bank, and then instructs the depositary bank to issue Depositary Receipts.

The MSCI All Country World Ex-U.S. Index (ACWI) is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus or summary prospectus, a copy of which may be obtained by visiting www.advisorshares.com. Please read the prospectus carefully before you invest. Foreside Fund Services, LLC, distributor.

There is no guarantee that the Fund will achieve its investment objective. An investment in the Fund is subject to risk, including the possible loss of principal amount invested. Emerging Markets, which consist of countries or markets with low to middle income economics can be subject to greater social, economic, regulatory and political uncertainties and can be extremely volatile. Other Fund risks include concentration risk, foreign securities and currency risk, ADRs which may be less liquid, large-cap risk, early closing risk, counterparty risk and trading risk, which can increase Fund expenses and may decrease Fund performance. The Fund is, also, subject to the same risks associated with the underlying ETFs, which can result in higher volatility. This Fund may not be suitable for all investors. See prospectus for detail regarding risk.

Shares are bought and sold at market price (closing price) not NAV and are not individually redeemed from the Fund. Market price returns are based on the midpoint of the bid/ask spread at 4:00 pm Eastern Time (when NAV is normally determined), and do not represent the return you would receive if you traded at other times.

Holdings and allocations are subject to risks and to change.

The views in this commentary are those of the portfolio manager and may not reflect his views on the date this material is distributed or anytime thereafter. These views are intended to assist shareholders in understanding their investments and do not constitute investment advice.