NAV as of 4/17/2024

$110.18

1 Day NAV Change as of 4/17/2024

$-1.02

Overall Morningstar Rating

Large Value

Based on risk-adjusted return out of 1,118 funds in the Large Value Overall Rating category as of March 31st, 2024.

4-Star

Morningstar Rated

Overall Morningstar Rating. Large Value. Based on risk-adjusted return out of 1,118 funds in the Large Value category as of March 31st, 2024.

| Symbol | Exchange | Inception Date | CUSIP |

|---|---|---|---|

| SURE | NYSE Arca | 10/4/2011 | 00768Y818 |

<strong>About the ETF</strong>

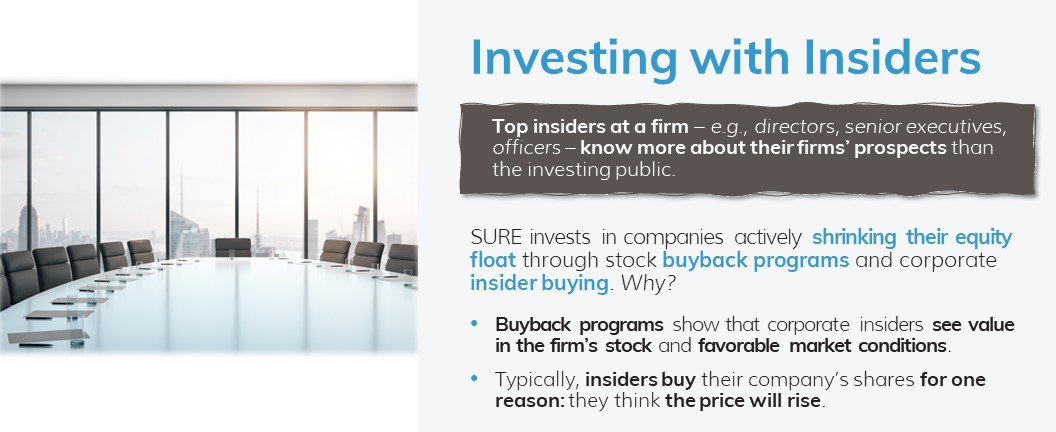

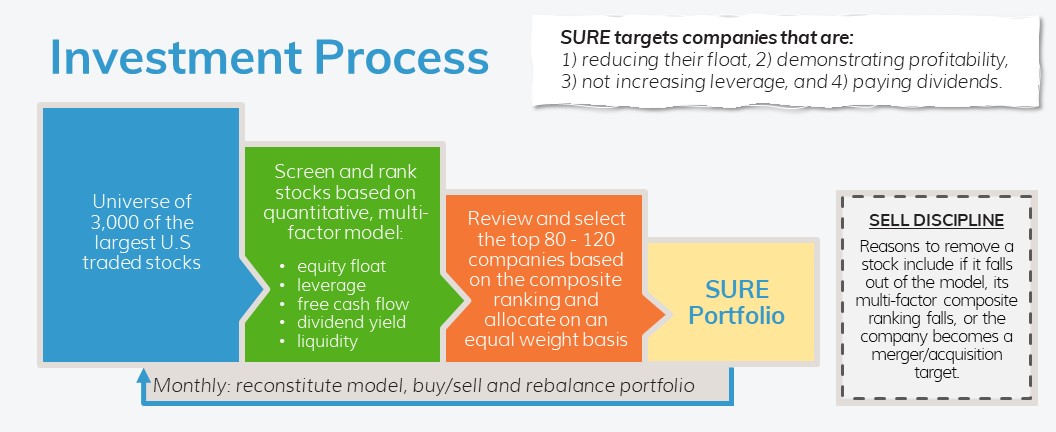

Following a core investment philosophy that corporate insiders know their companies the best, the AdvisorShares Insider Advantage ETF (SURE) seeks to invest in the equities of companies actively trying to reduce their public equity float through well-executed stock buyback programs and corporate insider buying. Not only do buybacks and insider buying demonstrate that executives may see relative value in the firm’s stock, they also could create favorable shareholder market conditions through the reduction of publicly available shares (float shrink). SURE selects holdings using an active, quantitative, multi-factor model to identify companies shrinking float, lowering leverage, growing free cash flow, and providing dividends. SURE’s holdings are equal-weighted and reconstituted/rebalanced monthly.

<strong>What Is Float Shrink?</strong>

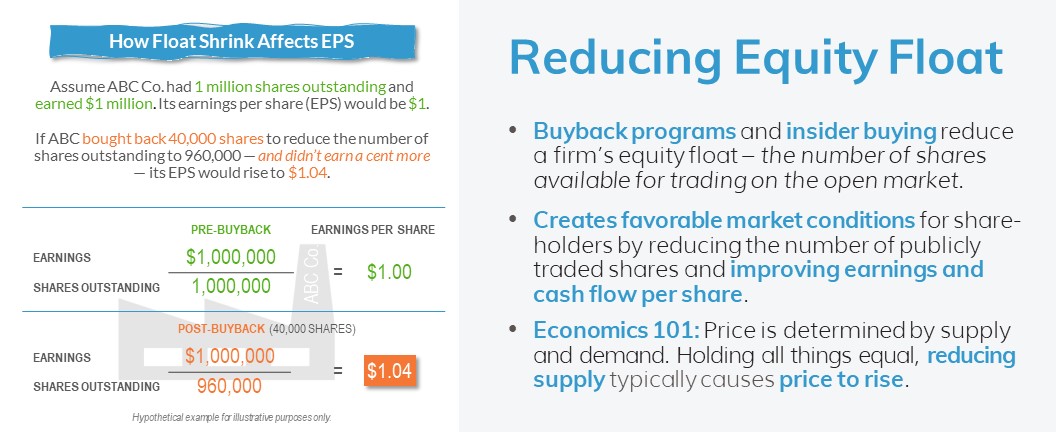

Public equity float refers to the portion of a company’s outstanding shares that is in the hands of public investors – as opposed to company officers, directors, or stockholders that hold controlling interests – and are available for trading in the open market. The float is calculated by subtracting restricted shares from outstanding shares. Float shrink occurs when there is a reduction of publicly available shares.

Buybacks – action taken by a corporation to repurchase its own shares from the marketplace – are the most common cause of float shrink today and one of two ways a company can distribute profits to shareholders. Dividend payments are the second form. While firms may implement both, since 1997, share buybacks have surpassed cash dividends to become the dominant form of corporate payout in the U.S. Not only do buybacks avoid a stock price penalty if a firm cuts or ends a program, like dividends are subject to, but also provide a positive market impact by improving earnings and cash flow per share.

Insider buying – the purchase of shares in a corporation by a board member, officer, or executive within that company (i.e., corporate insider) – is another way that float shrink occurs. It may be a strong indicator that insiders are becoming more optimistic about the company’s future. Buying by corporate insiders is legal, highly regulated, publicly disclosed, and different from “insider trading” – the illegal act of buying or selling stock by someone who has privileged, non-public information about a company.

<strong>Why Invest?</strong>

- Investing with Corporate Insiders – Top firm executives know more about the company’s fundamentals than the investing public. These insiders can influence their company’s share price by timing equity issuance and repurchase to the firm’s advantage. A well-implemented buyback program reduces publicly available shares and can increase the stock’s price. Additionally, corporate insider buying can be a bullish signal that the stock is underpriced by the market.

- Conscientious Float Shrink – Investing solely in stock buybacks can be problematic. SURE employs a comprehensive, multi-factor strategy to assess if a firm is reducing their float in a well-planned manner, analyzing free cash flow, profitability, leverage reduction, dividend yield, net buybacks and insider buying.

- Disciplined Growth – A quantitative, actively managed, equal weight investment strategy focused on long-term growth.

<strong>Key Attributes</strong>

- Float Shrink – Corporate insiders have better information than the investing public and know their companies the best. Stock buyback programs and insider buying not only show that corporate insiders see relative value in investing in their own equity securities, but also create favorable market conditions for shareholders by reducing the number of publicly traded shares and improving earnings and cash flow per share.

- Extensive Stock Screening – SURE’s portfolio manager screens approximately 3,000 companies and looks for the following characteristics when selecting stocks: shareholder-friendliness (measured by float shrink and dividend yield), profitability (measured by free cash flow), solid balance sheet (measured by outstanding leverage).

- Equal Weight Investing – In a market-cap weighted portfolio, a small number of the largest companies receive the heaviest allocations and overvalued components are overweighted relative to undervalued components. By contrast, with an equal weight strategy, the bias to the largest companies is removed; a buy low, sell high discipline is regularly followed with periodic rebalancing; and reallocation to undervalued stocks may provide the opportunity to capture long-term equity performance.

- Actively Managed ETF Structure – SURE is different from other buyback-focused investments that follow passive, market-cap weighted indexes and only reconstitute annually. SURE re-evaluates its investable universe and existing holdings monthly – adding or removing stocks and returning each security to an equal-weight allocation – allowing SURE to react more quickly to changes in buyback programs, acquisition announcements, etc. An ETF structure allows for better tax efficiency than mutual funds or than investing in the underlying stocks directly.

<strong>Where Can SURE Fit in a Traditional Portfolio?</strong>

SURE can serve as a thematic investment or a complement to a dividend investing or market-cap weighted core strategy.

<strong>About the Portfolio Strategist</strong>

Minyi Chen, Portfolio Strategist

Minyi Chen, CFA is the founder and CEO of Qubed Capital, a registered investment advisor founded in 2015 and based in Oakland, California. For over a decade, Mr. Chen has been providing quantitative financial research and analysis along with proprietary investment models to both retail and institutional investors. In the past, Mr. Chen has served as a portfolio manager of the AdvisorShares TrimTabs Float Shrink ETF (ticker: TTFS) and the TrimTabs International Free-Cash-Flow ETF (ticker: FCFI).

SURE Overview

Get a quick and easy introduction to the SURE ETF.

SURE Overview

Get a quick and easy introduction to the SURE ETF.

Fund

Price History

Fund Data

4/17/2024| NAV | $110.18 |

| Change | $-1.02 |

| Shares Outstanding | 430,000 |

| Assets Under Management | $47,379,016.3 |

Market Data

4/17/2024| Closing Price | $110.28 |

| Close Change | $-0.97 |

| Volume | 16 |

Regulatory Data

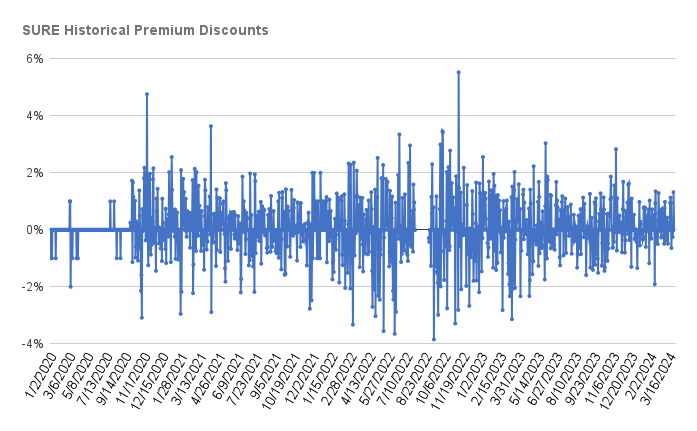

4/17/2024| Premium Discount | $-0.030 |

| 30-Day Median bid-ask Spread | 0.36 |

Shares are bought and sold at market price (closing price) not NAV and are not individually redeemed from the Fund. Market price returns are based on the midpoint of the bid/ask spread at 4:00 pm Eastern Time (when NAV is normally determined), and do not represent the return you would receive if you traded at other times.

FUND

Characteristics

As of 3/31/2024

SURE Market Capitalization

Source: Morningstar & AdvisorShares

SURE Sector Allocation

FUND

Performance

As of 3/31/2024

| NAV | Market Price Return | Russell 1000 Value | Russell 3000 Index | |

|---|---|---|---|---|

| 1 Month | 5.39 | 5.33 | 5.00 | 3.23 |

| 3 Months | 11.84 | 11.72 | 8.99 | 10.02 |

| YTD | 11.84 | 11.72 | 8.99 | 10.02 |

| 1 Year | 31.52 | 31.47 | 20.27 | 29.29 |

| 3 Years | 10.55 | 10.63 | 8.11 | 9.75 |

| 5 Years | 13.68 | 13.66 | 10.32 | 14.32 |

| Since Inception (10/04/2011, Annualized) | 13.80 | 13.80 | 12.46 | 14.98 |

As of 3/31/2024

| NAV | Market Price Return | Russell 1000 Value | Russell 3000 Index | |

|---|---|---|---|---|

| 1 Month | 5.39 | 5.33 | 5 | 3.23 |

| 3 Months | 11.84 | 11.72 | 8.99 | 10.02 |

| YTD | 11.84 | 11.72 | 8.99 | 10.02 |

| 1 Year | 31.52 | 31.47 | 20.27 | 29.29 |

| 3 Years | 10.55 | 10.63 | 8.11 | 9.75 |

| 5 Years | 13.68 | 13.66 | 10.32 | 14.32 |

| Since Inception (10/04/2011, Annualized) | 13.8 | 13.8 | 12.46 | 14.98 |

As of 3/31/2024

| NAV | Market Price Return | Russell 1000 Value | Russell 3000 Index | |

|---|---|---|---|---|

| 1 Month | 5.39 | 5.33 | 5.00 | 3.23 |

| 3 Months | 11.84 | 11.72 | 8.99 | 10.02 |

| YTD | 11.84 | 11.72 | 8.99 | 10.02 |

| 1 Year | 31.52 | 31.47 | 20.27 | 29.29 |

| Since 9/1/2022, Annualized | 22.78 | 22.94 | 14.74 | 34.73 |

Performance data quoted represents past performance and is no guarantee of future results. All Fund data and performance data quoted is believed to be accurate, and unless otherwise stated, is sourced from the Fund administrator, the Advisor’s or Sub-Advisor’s proprietary data, and Morningstar. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized.

*On September 1, 2022, the AdvisorShares DoubleLine Value Equity ETF (the “Predecessor Fund”) was renamed the AdvisorShares Insider Advantage ETF. The Predecessor Fund had different portfolio managers and investment strategy than the AdvisorShares Insider Advantage ETF. Performance prior to September 1, 2022 reflects the Fund’s performance prior to the change in manager and investment strategy and may not be indicative of the Fund’s performance under the new manager and revised investment strategy. Performance since September 1, 2022 reflects actual AdvisorShares Insider Advantage ETF performance.

Performance data quoted represents past performance and is no guarantee of future results. All Fund data and performance data quoted is believed to be accurate, and unless otherwise stated, is sourced from the Fund administrator, the Advisor’s or Sub-Advisor’s proprietary data, and Morningstar. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Returns less than one year are not annualized. One cannot invest directly in an index. The Russell 1000 Index represents the top 1000 companies by market capitalization in the United States. The index is a subset of the Russell 3000 Index. The Russell 3000 Index is broad market, capitalization-weighted index comprised of the largest 3,000 U.S. companies and represents 98% of the investable U.S. equity market.

Fund

Holdings

As of

| Date | Account Symbol | Stock Ticker | Security ID | Security Description | Shares | Share Price | Market Value | Portfolio Weight | Asset Group |

|---|---|---|---|---|---|---|---|---|---|

| 04/17/2024 | SURE | VST | 92840M102 | VISTRA CORP | 8,619.00 | 68.65 | 591,694.35 | 1.25% | S |

| WIRE | 292562105 | ENCORE WIRE CORP | 2,014.00 | 287.23 | 578,481.22 | 1.22% | S | ||

| AXP | 025816109 | AMERICAN EXPRESS CO | 2,570.00 | 217.67 | 559,411.90 | 1.18% | S | ||

| MUSA | 626755102 | MURPHY USA INC | 1,292.00 | 421.11 | 544,074.12 | 1.15% | S | ||

| EBAY | 278642103 | EBAY INC | 10,900.00 | 49.45 | 539,005.00 | 1.14% | S | ||

| EXP | 26969P108 | EAGLE MATERIALS INC | 2,200.00 | 244.85 | 538,670.00 | 1.14% | S | ||

| NRG | 629377508 | NRG ENERGY INC | 7,200.00 | 73.42 | 528,624.00 | 1.12% | S | ||

| VLO | 91913Y100 | VALERO ENERGY CORP | 3,143.00 | 167.28 | 525,761.04 | 1.11% | S | ||

| NUE | 670346105 | NUCOR CORP | 2,711.00 | 192.78 | 522,626.58 | 1.10% | S | ||

| HCA | 40412C101 | HCA HEALTHCARE INC | 1,680.00 | 311.03 | 522,530.40 | 1.10% | S | ||

| PHM | 745867101 | PULTEGROUP INC | 4,879.00 | 106.15 | 517,905.85 | 1.09% | S | ||

| LBRT | 53115L104 | LIBERTY ENERGY INC | 23,900.00 | 21.52 | 514,328.00 | 1.09% | S | ||

| PBF | 69318G106 | PBF ENERGY INC-CLASS A | 8,975.00 | 57.27 | 513,998.25 | 1.08% | S | ||

| CI | 125523100 | THE CIGNA GROUP | 1,483.00 | 346.08 | 513,236.64 | 1.08% | S | ||

| AWI | 04247X102 | ARMSTRONG WORLD INDUSTRIES | 4,400.00 | 114.69 | 504,636.00 | 1.07% | S | ||

| DD | 26614N102 | DUPONT DE NEMOURS INC | 6,900.00 | 73.09 | 504,321.00 | 1.06% | S | ||

| RTX | 75513E101 | RTX CORP | 5,000.00 | 100.75 | 503,750.00 | 1.06% | S | ||

| MTG | 552848103 | MGIC INVESTMENT CORP | 25,878.00 | 19.38 | 501,515.64 | 1.06% | S | ||

| META | 30303M102 | META PLATFORMS INC-CLASS A | 1,000.00 | 494.17 | 494,170.00 | 1.04% | S | ||

| HIG | 416515104 | HARTFORD FINANCIAL SVCS GRP | 5,100.00 | 95.78 | 488,478.00 | 1.03% | S | ||

| PSX | 718546104 | PHILLIPS 66 | 3,100.00 | 157.25 | 487,475.00 | 1.03% | S | ||

| MAR | 571903202 | MARRIOTT INTERNATIONAL -CL A | 2,044.00 | 238.46 | 487,412.24 | 1.03% | S | ||

| LRCX | 512807108 | LAM RESEARCH CORP | 529 | 912.26 | 482,585.54 | 1.02% | S | ||

| DPZ | 25754A201 | DOMINO'S PIZZA INC | 1,000.00 | 482.05 | 482,050.00 | 1.02% | S | ||

| SM | 78454L100 | SM ENERGY CO | 9,772.00 | 49.29 | 481,661.88 | 1.02% | S | ||

| STLD | 858119100 | STEEL DYNAMICS INC | 3,450.00 | 138.93 | 479,308.50 | 1.01% | S | ||

| CHD | 171340102 | CHURCH & DWIGHT CO INC | 4,630.00 | 103.49 | 479,158.70 | 1.01% | S | ||

| WING | 974155103 | WINGSTOP INC | 1,330.00 | 359.57 | 478,228.10 | 1.01% | S | ||

| AMG | 008252108 | AFFILIATED MANAGERS GROUP | 3,000.00 | 158.91 | 476,730.00 | 1.01% | S | ||

| UTZ | 918090101 | UTZ BRANDS INC | 27,400.00 | 17.35 | 475,390.00 | 1.00% | S | ||

| MGY | 559663109 | MAGNOLIA OIL & GAS CORP - A | 18,400.00 | 25.82 | 475,088.00 | 1.00% | S | ||

| CL | 194162103 | COLGATE-PALMOLIVE CO | 5,476.00 | 86.75 | 475,043.00 | 1.00% | S | ||

| GE | 369604301 | GENERAL ELECTRIC CO | 3,050.00 | 155.67 | 474,793.50 | 1.00% | S | ||

| CW | 231561101 | CURTISS-WRIGHT CORP | 1,900.00 | 249.67 | 474,373.00 | 1.00% | S | ||

| MPC | 56585A102 | MARATHON PETROLEUM CORP | 2,342.00 | 202.46 | 474,161.32 | 1.00% | S | ||

| LNG | 16411R208 | CHENIERE ENERGY INC | 3,015.00 | 156.81 | 472,782.15 | 1.00% | S | ||

| AAPL | 037833100 | APPLE INC | 2,814.00 | 168 | 472,752.00 | 1.00% | S | ||

| OC | 690742101 | OWENS CORNING | 2,900.00 | 162.9 | 472,410.00 | 1.00% | S | ||

| V | 92826C839 | VISA INC-CLASS A SHARES | 1,725.00 | 272.69 | 470,390.25 | 0.99% | S | ||

| ASH | 044186104 | ASHLAND INC | 5,000.00 | 93.89 | 469,450.00 | 0.99% | S | ||

| TT | G8994E103 | TRANE TECHNOLOGIES PLC | 1,600.00 | 293.09 | 468,944.00 | 0.99% | FS | ||

| HLT | 43300A203 | HILTON WORLDWIDE HOLDINGS IN | 2,336.00 | 200.48 | 468,321.28 | 0.99% | S | ||

| BG | H11356104 | BUNGE GLOBAL SA | 4,440.00 | 105.42 | 468,064.80 | 0.99% | FS | ||

| LDOS | 525327102 | LEIDOS HOLDINGS INC | 3,750.00 | 124.36 | 466,350.00 | 0.98% | S | ||

| CAT | 149123101 | CATERPILLAR INC | 1,300.00 | 358.32 | 465,816.00 | 0.98% | S | ||

| CSL | 142339100 | CARLISLE COS INC | 1,262.00 | 368.84 | 465,476.08 | 0.98% | S | ||

| WAB | 929740108 | WABTEC CORP | 3,220.00 | 144.55 | 465,451.00 | 0.98% | S | ||

| ODFL | 679580100 | OLD DOMINION FREIGHT LINE | 2,200.00 | 210.81 | 463,782.00 | 0.98% | S | ||

| OXY | 674599105 | OCCIDENTAL PETROLEUM CORP | 7,018.00 | 65.98 | 463,047.64 | 0.98% | S | ||

| MA | 57636Q104 | MASTERCARD INC - A | 1,006.00 | 460.16 | 462,920.96 | 0.98% | S | ||

| EA | 285512109 | ELECTRONIC ARTS INC | 3,664.00 | 126.31 | 462,799.84 | 0.98% | S | ||

| PJT | 69343T107 | PJT PARTNERS INC - A | 5,000.00 | 92.22 | 461,100.00 | 0.97% | S | ||

| CMC | 201723103 | COMMERCIAL METALS CO | 8,250.00 | 55.87 | 460,927.50 | 0.97% | S | ||

| ALSN | 01973R101 | ALLISON TRANSMISSION HOLDING | 5,770.00 | 79.78 | 460,330.60 | 0.97% | S | ||

| VSEC | 918284100 | VSE CORP | 6,000.00 | 76.67 | 460,020.00 | 0.97% | S | ||

| CTS | 126501105 | CTS CORP | 10,500.00 | 43.8 | 459,900.00 | 0.97% | S | ||

| RYAN | 78351F107 | RYAN SPECIALTY HOLDINGS INC | 9,130.00 | 50.33 | 459,512.90 | 0.97% | S | ||

| TRS | 896215209 | TRIMAS CORP | 18,340.00 | 25.04 | 459,233.60 | 0.97% | S | ||

| DOX | G02602103 | AMDOCS LTD | 5,390.00 | 84.93 | 457,772.70 | 0.97% | FS | ||

| PVH | 693656100 | PVH CORP | 4,320.00 | 105.75 | 456,840.00 | 0.96% | S | ||

| WNC | 929566107 | WABASH NATIONAL CORP | 17,600.00 | 25.9 | 455,840.00 | 0.96% | S | ||

| COP | 20825C104 | CONOCOPHILLIPS | 3,550.00 | 128.33 | 455,571.50 | 0.96% | S | ||

| EOG | 26875P101 | EOG RESOURCES INC | 3,440.00 | 132.4 | 455,456.00 | 0.96% | S | ||

| BWXT | 05605H100 | BWX TECHNOLOGIES INC | 4,900.00 | 92.91 | 455,259.00 | 0.96% | S | ||

| SPG | 828806109 | SIMON PROPERTY GROUP INC | 3,230.00 | 140.94 | 455,236.20 | 0.96% | S | ||

| GM | 37045V100 | GENERAL MOTORS CO | 10,700.00 | 42.46 | 454,322.00 | 0.96% | S | ||

| TOL | 889478103 | TOLL BROTHERS INC | 4,000.00 | 113.42 | 453,680.00 | 0.96% | S | ||

| NWS | 65249B208 | NEWS CORP - CLASS B | 18,180.00 | 24.95 | 453,591.00 | 0.96% | S | ||

| WST | 955306105 | WEST PHARMACEUTICAL SERVICES | 1,200.00 | 377.36 | 452,832.00 | 0.96% | S | ||

| MCHP | 595017104 | MICROCHIP TECHNOLOGY INC | 5,320.00 | 85.07 | 452,572.40 | 0.96% | S | ||

| WRB | 084423102 | WR BERKLEY CORP | 5,600.00 | 80.71 | 451,976.00 | 0.95% | S | ||

| ROST | 778296103 | ROSS STORES INC | 3,400.00 | 132.79 | 451,486.00 | 0.95% | S | ||

| AON | G0403H108 | AON PLC-CLASS A | 1,480.00 | 304.79 | 451,089.20 | 0.95% | FS | ||

| KBH | 48666K109 | KB HOME | 7,400.00 | 60.92 | 450,808.00 | 0.95% | S | ||

| VNT | 928881101 | VONTIER CORP | 11,160.00 | 40.39 | 450,752.40 | 0.95% | S | ||

| RL | 751212101 | RALPH LAUREN CORP | 2,830.00 | 159.25 | 450,677.50 | 0.95% | S | ||

| JBL | 466313103 | JABIL INC | 3,470.00 | 129.65 | 449,885.50 | 0.95% | S | ||

| TEX | 880779103 | TEREX CORP | 7,400.00 | 60.71 | 449,254.00 | 0.95% | S | ||

| GNTX | 371901109 | GENTEX CORP | 13,400.00 | 33.51 | 449,034.00 | 0.95% | S | ||

| TMO | 883556102 | THERMO FISHER SCIENTIFIC INC | 820 | 547.25 | 448,745.00 | 0.95% | S | ||

| MRO | 565849106 | MARATHON OIL CORP | 16,200.00 | 27.68 | 448,416.00 | 0.95% | S | ||

| BGC | 088929104 | BGC GROUP INC-A | 59,600.00 | 7.52 | 448,192.00 | 0.95% | S | ||

| AMAT | 038222105 | APPLIED MATERIALS INC | 2,240.00 | 199.89 | 447,753.60 | 0.95% | S | ||

| GWW | 384802104 | WW GRAINGER INC | 470 | 949.92 | 446,462.40 | 0.94% | S | ||

| MSCI | 55354G100 | MSCI INC | 870 | 511.83 | 445,292.10 | 0.94% | S | ||

| BMY | 110122108 | BRISTOL-MYERS SQUIBB CO | 9,299.00 | 47.84 | 444,864.16 | 0.94% | S | ||

| BDC | 077454106 | BELDEN INC | 5,400.00 | 82.33 | 444,582.00 | 0.94% | S | ||

| CHX | 15872M104 | CHAMPIONX CORP | 12,300.00 | 36.07 | 443,661.00 | 0.94% | S | ||

| CTVA | 22052L104 | CORTEVA INC | 8,270.00 | 53.53 | 442,693.10 | 0.93% | S | ||

| AYI | 00508Y102 | ACUITY BRANDS INC | 1,770.00 | 248.72 | 440,234.40 | 0.93% | S | ||

| WYNN | 983134107 | WYNN RESORTS LTD | 4,500.00 | 97.48 | 438,660.00 | 0.93% | S | ||

| SHO | 867892101 | SUNSTONE HOTEL INVESTORS INC | 43,300.00 | 10.12 | 438,196.00 | 0.92% | S | ||

| OLN | 680665205 | OLIN CORP | 8,234.00 | 53.18 | 437,884.12 | 0.92% | S | ||

| GHC | 384637104 | GRAHAM HOLDINGS CO-CLASS B | 630 | 695 | 437,850.00 | 0.92% | S | ||

| POOL | 73278L105 | POOL CORP | 1,200.00 | 364.15 | 436,980.00 | 0.92% | S | ||

| KLAC | 482480100 | KLA CORP | 662 | 658.98 | 436,244.76 | 0.92% | S | ||

| RMD | 761152107 | RESMED INC | 2,500.00 | 173.83 | 434,575.00 | 0.92% | S | ||

| BCC | 09739D100 | BOISE CASCADE CO | 3,150.00 | 137.8 | 434,070.00 | 0.92% | S | ||

| NMRK | 65158N102 | NEWMARK GROUP INC-CLASS A | 45,100.00 | 9.51 | 428,901.00 | 0.91% | S | ||

| HOG | 412822108 | HARLEY-DAVIDSON INC | 11,200.00 | 37.94 | 424,928.00 | 0.90% | S | ||

| CASH | 162,901.66 | 100 | 162,901.66 | 0.34% | CA | ||||

| X9USDBLYT | BLACKROCK TREASURY TRUST INSTL 62 | 63,090.54 | 1 | 63,090.54 | 0.13% | MM |

FUND

Fees & Expenses

| Management Fee | 0.70% |

| Total Annual Operating Expenses | 1.05% |

| Fee Waiver/Expense Reimbursement* | -0.15% |

| Total Annual Operating Expenses After Waiver/Reimbursement | 0.90% |

*The Advisor has contractually agreed to keep net expenses from exceeding 0.90% of the Fund’s average daily net assets for at least one year from the date of the prospectus. For more information, please read the full prospectus.

Last Ten

Fund Distributions

The Morningstar Rating™ for funds, or “star rating,” is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. Past performance is no guarantee of future results.

©2024 Morningstar, Inc. All Rights Reserved. Morningstar and/or its content providers are the proprietors of this information; do not permit its unauthorized copying or distribution; do not warrant it to be accurate, complete or timely; and are not responsible for damages or losses arising from its use.

SURE received three stars for the 3-year rating among 1,118 funds, four stars for the 5-year rating among 1,058 funds, four stars for the 10-year rating among 816 funds, and four stars for the overall rating among 1,118 funds in Morningstar’s Large Value category as of March 31st, 2024.

ETF

Social

Conversation